Investors are breathing a sigh of relief—and putting the “Sell America” trade on pause.

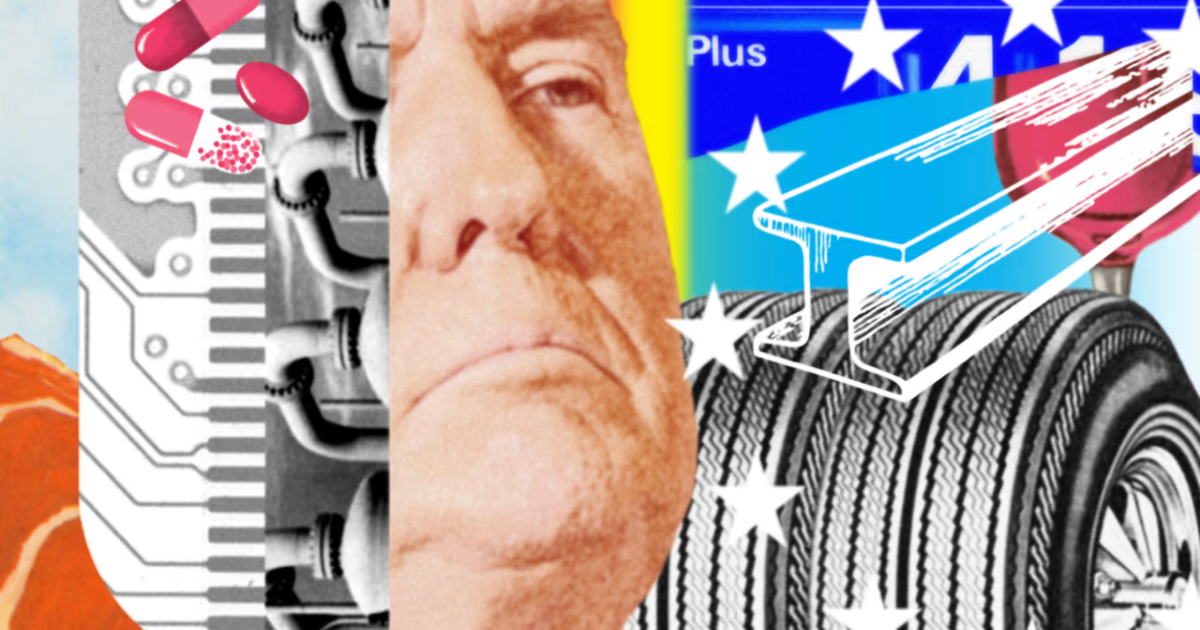

A rally in U.S. stocks continued for a second day, after the Trump administration addressed two of the market’s biggest concerns by softening its tone on both China and the Federal Reserve.

Stocks have traded off their highs from this morning after Bloomberg quoted Treasury Secretary Scott Bessent as saying President Trump hasn’t offered to take down U.S. tariffs on China on a unilateral basis. The index recently was recently up 1.4%.

The Trump administration is considering slashing steep tariffs on Chinese imports—in some cases by more than half—in a bid to de-escalate tensions with Beijing, The Wall Street Journal reported.

Late Tuesday, President Trump had said tariffs on China “will come down substantially,” while Treasury Secretary Scott Bessent told investors he believes a trade deal with Beijing can be reached. “America first does not mean America alone,” he said at a finance-industry conference Wednesday.

Meantime, investors eyed global business surveys for insight into how Trump’s efforts to rewrite the rules of trade are affecting the real economy.

Purchasing managers indexes showed eurozone activity weakened in April, but picked up in Japan and India. U.S. data showed business expectations about the year ahead falling to some of the lowest levels registered postpandemic.

All three major U.S. indexes climbed. The S&P 500 rose 1.7%, while the Nasdaq Composite added more than 2.5%.

Tesla shares gained, even though earnings missed expectations. Chief Executive Elon Musk said he would dial back his work with the Trump administration.

Gold retreated, trading below $3,300 a troy ounce. It had hit a record high Tuesday above $3,500.

Longer-term Treasurys rallied, with 10-year yields trading around 4.34%.

The dollar strengthened modestly.

Bitcoin ran up further, trading near $93,000.